Andrei Rogobete: A High Savings Ratio is Nothing to Cheer About

On the surface, one of the few bright spots of the second quarter of this year was a sharp rise in the UK’s savings ratio. But though an increase of 29% sounds like good news, in reality it’s quite the opposite.

More than anything, the surge in saving signals an economy in deadlock. Rather than a welcome form of organic growth, lockdown has resulted in ‘forced’ savings, where discretionary spending (for both individuals and households) has been restricted by compulsion, not choice.

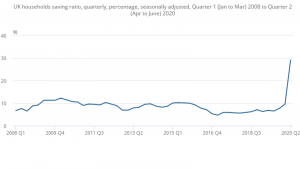

The UK’s savings ratio hit a record 29.1% in the second quarter of 2020 according to the latest data from the Office for National Statistics (2020). The ratio is based on how much households are able to save in proportion to their disposable income. According to research conducted by Aviva more than £80bn has been deposited in the six months since lockdown began in March. That is the equivalent to about £3,000 per household. The graph below illustrates this (rather dramatic) increase from the pre-lockdown levels of 5-6% to over 29%.

A first observation is that an increase in the savings ratio may come as no surprise to many analysts. This is largely due to the economic impact of Covid-19, spending on non-essential items and activities (e.g. eating out, leisure, and travel) fell by some 35% while “stay-at-home” products such as online subscriptions, household goods, and DIY improvements rose by 6%. This at least in part explains the 29% savings ratio.

A second observation is that people are more reluctant to spend and more likely to save during times of economic uncertainty – particularly when many sectors of the economy are faced with mounting job losses. We have seen this before in the aftermath of the 2007-08 financial crisis when the savings ratio increased from 6.5% to 12.2%.

A third observation to make is that while the savings ratio has gone up, interest rates across the board have gone down – with some moving worryingly close to 0%. The National Savings and Investments (NS&I) made headlines recently when they issued “devastating” cuts to their interest rates on savings accounts, with Income Bonds reaching a low of 0.01% and impacting 25 million people. Yet the problem is even more widespread with retail savings accounts seeing their interest rates slashed across the board. This all makes for a very difficult environment for savings.

For many the outlook is bleak

Despite encouraging news about a 29% savings ratio, the outlook for many whose jobs are at risk is permeated with financial instability and the emotional toll that it brings. The UK’s economy contracted by 19.8% in the second quarter of 2020 and one third of UK employers are expected to make redundancies over the winter season. This points to a dichotomy of outcome: we are not all in the same boat. There is a stark difference in savings between those who have maintained a steady stream of income throughout this period and those that have not. The latter will unfortunately bear the economic brunt and see their savings diminish or even fall into debt. The Bank of England estimates that even with a source of income, households earning less than £35,000 per annum have seen their savings decrease, while those earning above that figure have seen them increase.

The big picture requires balancing

Every crisis has a silver lining, and the 29% savings ratio can be a good opportunity to set the pace and tone in post-Covid Britain. One where a significant proportion of households are able to prudently spend from a much healthier financial position.

Yet this will likely be met with strong opposition from those in power who will do everything they can to encourage spending. We are likely to see “Eat out to help out” all over again even negative interest rates in 2021 should the pandemic worsen, and Brexit talks fail. These would be devastating for savings.

AJ Bell analyst Tom Selby said that, “From the government’s perspective, the higher savings ratio presents a short-term problem as it partly reflects the parlous state of the wider UK economy […] It also perhaps explains why Bailey is toying with introducing negative interest rates for the first time in a desperate bid to get people to spend more of their spare cash”.

This raises further questions for discussion: First, how do we keep the economy afloat without effectively placing a tax on savings? Second, how can those that are now (or will be) out of employment receive the support they need? Particularly, since certain sectors of the economy (e.g. hospitality) are closed on a temporary basis. Third, how can the current savings ratio be used to promote a more widespread culture of saving in the long run?

For policymakers and those in government, the tension between re-starting the economy and not penalising people for saving is a fine balancing act that will require careful attention and thought.

Andrei E. Rogobete is the Associate Director of the Centre for Enterprise, Markets & Ethics. For more information about Andrei please click here.